Newspaper Article 10/06/2014

National economy suffers from five perennial ills: deficit; debt; black economy; lack of capacity for capital growth and negative effects of population expansion. Budget 2014-15 makes an attempt to mitigate all five, though in varying degrees. Government presented the budget amid rising unease amongst the general public that past year did not yield the promised positive results. Some experts say that it is more of an aspirational document, because in some of the sectors, government has not even broken-down figures between administrative expenses and development funding; hence leaving the people guessing of what is being done, for example, in health and education sectors. Government’s economic wizards have boasted of their success in increasing the foreign reserves of the country and pointed to the rising value of the rupee against the dollar as an indicator of growth, but the overall economic growth is still marginal at best.

Two of the six elements of ruling party’s economic vision have been complied with in the budget document i.e. to make private sector the primary engine of economic development; and public sector investment to cater for building a strong infrastructure of roads, highways, railways, ports, water, hydro-power etc. However, one can’t be too sure whether the goal of promoting trade and investment and protection of economic sovereignty has been followed wholeheartedly. While budget seems to promote trade and investment, the economic sovereignty part is easier said than done, unless the economy itself gets sustainably strong and robust.

Inflation is reported at 8.34 percent. Improved reserves position and a stable currency have also contributed in keeping the Consumer Price Index in check. Internationally, crude oil prices are tipped to slide even further on account of oversupply; hence easing the pressure on Pakistani economy. Overall mood and expectations are for lower inflation in the near future. The GDP growth rate of 4.14 percent is higher than the previous year’s rate of 3.7%; yet short of the government’s target figure of 4.4%. Finance minister has pledged that the government would try to increase the growth rate by 1% every year taking it to 7% by 2017.

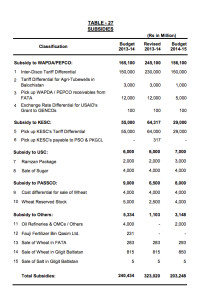

Good indicators are that growth in the manufacturing sector exceeded its target of 4.5% and stood at 5.5%; and the services sector witnessed a growth of 4.85% against the prediction of 4.5%.  The industrial sector recorded a robust growth of 5.8% during the first nine months of this fiscal year compared to 5.4% during last year. Industrial sector contributes around 20.8 percent to GDP; it is also a major source of tax revenue for the government, apart from creating significant job opportunities. The manufacturing sector is an important sub-sector of industrial sector with 64.92% share in the sector. Construction, with 11.48 percent share in industrial sector, expanded by 11.31 percent against last year’s negative growth of 1.68%. This is the highest ever growth achieved by this sector since 2008-09.Growth in agriculture fell short of target: 2.12 against 3.8 percent. Though agriculture is a major sector of national economy catering for 26% of GDP, ironically its contribution toward national tax is only 01 percent.Next year’s budget projects an increase in indirect taxation and increasing the burden of taxes on the salaried workforce of the country instead of bringing the wealthiest of the country into the tax net; move is partly driven by government’s commitment to increase private investment in the country. Tax exemptions enjoyed by industrialists, feudal lords and companies rose by a staggering 99 per cent during this fiscal year: an increase of Rs237.57b. While at the same time, Federal Board of Revenue (FBR) has witnessed a shortfall of Rs200 billion in revenue collection. The budget also envisages a massive reduction in federal subsidies, from Rs 323 billion to 203 billion rupees. However, during the current year, the difference between the budgeted subsidies and the revised estimates was Rs83 billion, the trend is likely to continue.

The industrial sector recorded a robust growth of 5.8% during the first nine months of this fiscal year compared to 5.4% during last year. Industrial sector contributes around 20.8 percent to GDP; it is also a major source of tax revenue for the government, apart from creating significant job opportunities. The manufacturing sector is an important sub-sector of industrial sector with 64.92% share in the sector. Construction, with 11.48 percent share in industrial sector, expanded by 11.31 percent against last year’s negative growth of 1.68%. This is the highest ever growth achieved by this sector since 2008-09.Growth in agriculture fell short of target: 2.12 against 3.8 percent. Though agriculture is a major sector of national economy catering for 26% of GDP, ironically its contribution toward national tax is only 01 percent.Next year’s budget projects an increase in indirect taxation and increasing the burden of taxes on the salaried workforce of the country instead of bringing the wealthiest of the country into the tax net; move is partly driven by government’s commitment to increase private investment in the country. Tax exemptions enjoyed by industrialists, feudal lords and companies rose by a staggering 99 per cent during this fiscal year: an increase of Rs237.57b. While at the same time, Federal Board of Revenue (FBR) has witnessed a shortfall of Rs200 billion in revenue collection. The budget also envisages a massive reduction in federal subsidies, from Rs 323 billion to 203 billion rupees. However, during the current year, the difference between the budgeted subsidies and the revised estimates was Rs83 billion, the trend is likely to continue.

Confidence displayed by the finance minister last year over his economic revival plans did not translate into achieving targets that he had set for himself. Tax-to-GDP ratio stood at only 8.8% against 9.5 percent. The government also missed the target of economic growth, investment and savings, the three core measures that depict the real health of the economy. Investment to GDP ratio remained at 14% against a target of 15.1%. The ratio was below last year’s rate of 14.6 percent; however budget deficit target of 5.8% of the GDP was accomplished.

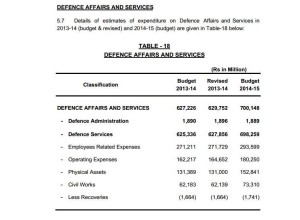

The Senate defence committee was informed by the ministry of defence that Pakistan’s defence budget is the lowest in the region despite its location in the red zone in terms of growing threats to its security .Pakistan has raised its defence spending by 11.1 per cent for the coming fiscal year. India, earlier this year, jacked up military spending by 10%. Defence budget has been jacked up to Rs700. 2 billion, compared with Rs 627.2 billion allocated in the outgoing fiscal year, showing an increase of Rs 73 billion. The military, however, had sought an increase of Rs 173 billion. Defence entities recycled Rs 34 billion into national economy on account of various taxes. Out of the defence budget, Pakistan Army gets 48 per cent while 20 percent goes to Pakistan Air force and Navy’s share is 10 percent. Out of Rs 700.2 billion, Rs 293.5 billion have been allocated for employees related expenses, Rs 180.2 billion for operating expenses and Rs 152.8 billion have been earmarked for physical assets. Given the internal security challenges much of the increase in the defense budget is likely to be spent on the fight against militancy. The tooth-to-tail ratio of the defence allocation, which has normally stood at around 20:80, has slightly improved to 22:78. This ratio helps compare the amount earmarked for hard core combat and support functions. This improvement shows that military has done some, in-house, economic belt tightening.

.Pakistan has raised its defence spending by 11.1 per cent for the coming fiscal year. India, earlier this year, jacked up military spending by 10%. Defence budget has been jacked up to Rs700. 2 billion, compared with Rs 627.2 billion allocated in the outgoing fiscal year, showing an increase of Rs 73 billion. The military, however, had sought an increase of Rs 173 billion. Defence entities recycled Rs 34 billion into national economy on account of various taxes. Out of the defence budget, Pakistan Army gets 48 per cent while 20 percent goes to Pakistan Air force and Navy’s share is 10 percent. Out of Rs 700.2 billion, Rs 293.5 billion have been allocated for employees related expenses, Rs 180.2 billion for operating expenses and Rs 152.8 billion have been earmarked for physical assets. Given the internal security challenges much of the increase in the defense budget is likely to be spent on the fight against militancy. The tooth-to-tail ratio of the defence allocation, which has normally stood at around 20:80, has slightly improved to 22:78. This ratio helps compare the amount earmarked for hard core combat and support functions. This improvement shows that military has done some, in-house, economic belt tightening.

The economy was in an infirm state when the new government came into power. Beside, fiscal restrictions imposed by the IMF made the options quite limited for the government to be able to show any worthwhile popularity focused results.Assessment of government’s economic performance in its first year sharply contrasts with Finance Minister’s claims that the economy was on a path of revival; most of the key economic targets could not be achieved — pointing towards consequences of delays in introducing tough structural reforms. “In one year economic reforms cannot be completed and the economy cannot be revived within one year,” admitted Dar.He said that the first year was consumed in firefighting to help stabilize the economy.

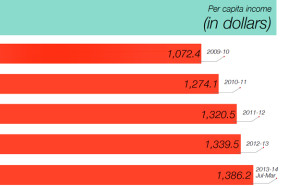

The performance in investment, savings and sub-sectors of agriculture and services was even worse than that witnessed during the five year of previous government. “We have missed the targets but we still achieved 75% to 80% of our goals against each target,” said the finance minister. He said the government had set stretched targets in the first place to make sure all stakeholders give their 100% to improve the economy.The business is full of praise for a ‘growth oriented’ budget, while working classes see no benefit for themselves. It is clear that Pakistan is not likely to achieve the UN’s Millennium Development goals by its deadline of 2018 in important healthcare indicators like infant & maternal mortality, and waterborne diseases. Country’s per capita income grew at a disappointing 1.4 percent amounting to $1,386 per person. The government needs to relook at the Budget document to find ways and means to mitigate suffocating economic burden of the masses.

“We have missed the targets but we still achieved 75% to 80% of our goals against each target,” said the finance minister. He said the government had set stretched targets in the first place to make sure all stakeholders give their 100% to improve the economy.The business is full of praise for a ‘growth oriented’ budget, while working classes see no benefit for themselves. It is clear that Pakistan is not likely to achieve the UN’s Millennium Development goals by its deadline of 2018 in important healthcare indicators like infant & maternal mortality, and waterborne diseases. Country’s per capita income grew at a disappointing 1.4 percent amounting to $1,386 per person. The government needs to relook at the Budget document to find ways and means to mitigate suffocating economic burden of the masses.

Carried by The Nation on June 08, 2014.

Disclaimer: Views expressed are of the writer and are not necessarily reflective of IPRI policy.